Inequality

A report by the Organisation for Economic Cooperation and Development (OECD) called for redistributive fiscal policy to disrupt inequality and spur economic growth. The Guardian’s Larry Elliott described the report’s conclusion: “Income inequality has a sizeable and statistically negative impact on growth, and that redistributive policies achieving greater equality in disposable income has no adverse growth consequences.” Beyond hampering growth, the OECD contended that widening inequality has created a drag on major western economies. Jennifer Ryan reported in Bloomberg News that “inequality knocked about 6-7 percentage points off U.S. gross domestic product growth between 1990 and 2010.” According to the OECD, policymakers do not have to make trade-offs between promoting growth and addressing inequality. Quite the contrary, “policies that help to limit or reverse inequality may not only make societies less unfair, but also wealthier.”

Demos’s Sean McElwee wrote an insightful piece in Salon on how to correct the United States’ racial wealth gap. Pointing to intergenerational wealth transfers as the primary cause of wealth accumulation, McElwee outlined the intractable economic position of American minorities: “The residual effects of wealth remain for 10-to-15 generations. Given that most Americans are only four generations removed from slavery and one generation away from segregated neighborhoods, restrictive covenants and all white colleges, the only truly surprising fact is that the racial wealth gap is not larger.” Eviscerating the idea that wealth inequality can be eradicated with education or rising incomes, McElwee called for progressive fiscal policy. Specifically, he recommended automatic baby bonds for three-quarters of Americans, which could reduce wealth inequality in as little as three generations.

Gentrification

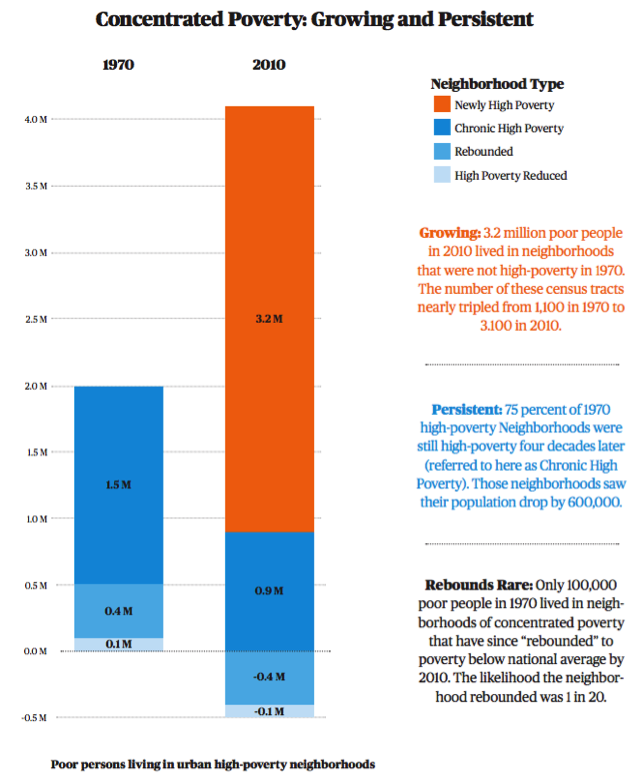

This week several news outlets ran stories on the economic consequences of gentrification and concentrated poverty in American cities. Most found grounding in a report by Joe Cortright and Dillon Mahmoudi that was published in the City Observatory, which maintained that the “persistence and spread of concentrated poverty, not gentrification, is our biggest urban challenge.”

The Guardian’s Jana Kasperkevic noted the gentrification of high-poverty neighborhoods is relatively rare in urban centers. There are only about 105 neighborhoods that meet such criteria. Kasperkevic argued instead that the decline of urban racial segregation has exacerbated high-poverty neighborhoods: “As African Americans gained more income and education and moved away from their communities, the economic diversity of those communities dropped into deeper poverty.” Danielle Kurtzleben of Vox echoed these concerns: “Residents of poor neighborhoods are increasingly sectioned off from people who do not live in poverty. More economic segregation means less economic mobility — the more poor people live separate from rich people, the less likely they are to move up the income ladder.” Kurtzleben cited research by the Pew Economic Mobility Project on how economic segregation perpetuates intergenerational poverty. In segregated cities, "parents also can transmit advantage by selecting a home in a wealthier community, where the schools are likely to be of higher quality and where there are probably greater economic opportunities… low-income families are likely to live in disadvantaged neighborhoods, where schools are lower quality, crime and violence are more common, and economic opportunities are scarce.”

Technology

Exploration into how technology can be leveraged to reduce inequality is producing innovative solutions to social problems like equity in education, transportation, and financial inclusion. “Technology has contributed to the rise in inequality, but there are also some significant ways in which technology could reduce it,” Tyler Cowen wrote in The New York Times’s Upshot blog. Jackie Mader highlighted the efforts of Piedmont City Schools to serve its rural Alabama community by providing each student with a laptop. Mader identified an important distinction between school districts with digital programs and Piedmont: “[Piedmont has a] goal that’s broader than creating high-tech classrooms… the district hopes to resuscitate a dying rural town." Living Cities commissioned a report on how shared mobility, like bike sharing systems, can connect low income people to opportunity.

The Asset Building Program hosted “Cashing in on Digital Payments: Can cash delivery pathways promote enduring economic infrastructures?” The event explored the potential of digital payments as a cash transfer modality for long-term economic development. Watch it here.

Quick Hits

Door Ways to Dreams (D2D) applauded the passage of the American Savings Promotion Act, which will remove barriers to allowing banks to offer incentives and prizes to customers who open and contribute to savings accounts.

Linda Borg reported a change to Rhode Island’s college savings program that will allow parents to sign up their newborns for the program by simply checking a box on birth certification.