The Budget

This week President Obama released his Fiscal Year (FY) 2016 Budget. The proposal contained few surprises, as most of its content was road tested during (and before) the State of the Union. One idea that was conspicuously missing was the President’s plan to tax earnings in 529 college savings plans. New America Fellow Monica Potts described how this idea met a quick death for The Daily Beast. New America’s The Weekly Wonk also covered the budget. Andrew Soergel of U.S. News outlined the budget’s major expenditures. The Center on Budget and Policy Priorities’ Robert Greenstein released a statement on the budget: “President Obama is proposing a surprisingly ambitious budget that would make progress — in some cases modest, in others large — in various areas in which policy sclerosis has prevented the nation from addressing significant problems.” President of CLASP Olivia Golden described how the budget would help low-income families and youth. Nick Otto reported that the budget makes provisions to alleviate legal obstacles to state-run auto-IRA proposals for employees of companies that do not offer retirement plans. HUD’s Family Self-Sufficiency program received a bump in funding.

College Completion

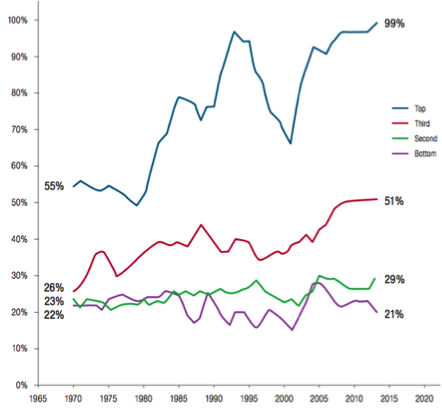

A recent study by the University of Pennsylvania and the Pell Institute for Study of Opportunity in Higher Education explored the educational outcomes of students aged 18-24 from different economic backgrounds over the past 45 years. Gillian B. White explicated the study’s findings in The Atlantic: “Researchers found that when it comes to completing higher-education degrees, the gap between the rich and the poor has actually grown significantly.” In 2013, students from the top income bracket (households making over $108,650) were eight times more likely to graduate with a bachelor’s degree than students from the bottom income bracket (household making less than $34,160). In 1970, wealthy students were only five times more likely to graduate from college than their low-income counterparts. Melissa Korn of The Wall Street Journal explained that while college access is a major policy focus, less emphasis is placed on college retention rates. Al Jazeera America commented on the report, noting that completion rates vary widely by school type: “More students from the lowest-income families are in public two-year institutions, which tend to have lower completion rates, while those from wealthier families are more abundant in schools that grant doctoral degrees.”

Geography and Economics

Several newly published reports have shed light on the extent to which where you live has an impact on your financial wellbeing and economic prospects. Last week, CFED released its 2015 Assets and Opportunities Scorecard. The study found that financial security and economic opportunity are at their lowest in the South and Southwest. A Stanford Center on Poverty and Inequality report explored the diversity of poverty and inequality in all 50 states. Researchers discovered that “while some states are deeply disadvantaged, other states have found ways to create a more vibrant labor market and fashion more viable institutions, among other strategies.” According to the center's director, David Grusky, "it matters a lot where the stork drops the child." If the child is unluckily dropped into a struggling state, she’s at risk of "growing up poor and unhealthy, failing to get a good job, and losing out on the American dream." Mike Maciag for Governing Magazine covered a report by the National Association of Counties that analyzed the strength of the recovery at the county level. The data took into account four factors: job totals, unemployment rates, economic output (GDP), and median home prices. It concluded that the recovery has been massively uneven: “only 65 countries have seen all four economic measures fully recover from pre-recession peaks.”

Quick Hits

Kentucky Treasurer Todd Hollenbach proposed a retirement savings bill – similar to Illinois’ Secure Choice program – that could cover 786,000 workers, Marty Finley reported.

The Pew Trusts released a new report that explores the precarious state of family balance sheets. The report highlights the widespread lack of emergency savings, calculating that the typical low-income family has enough savings to replace just nine days’ worth of income.

Illinois State Senator Daniel Biss described how the Secure Choice program could be a model for fixing America’s retirement savings shortfall for Talk Poverty.