Retirement Savings

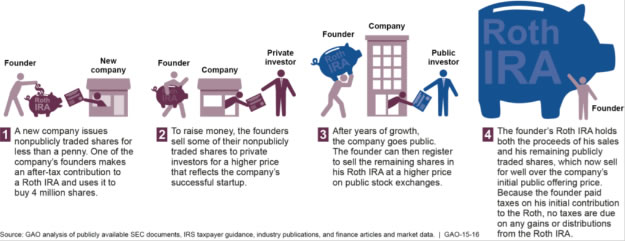

This week analysts unpacked a new report by the Government Accountability Office (GAO) on Mega-IRAs, a mechanism by which Roth IRA accounts are used to avoid paying taxes on millions. Bloomberg’s Richard Rubin explained how wealthy individuals have gotten around the $5,500 contribution limits: “Company founders can fill retirement accounts with stock that isn’t publicly traded. They use low values to stay technically under the contribution limit. After the stock rises in value, they can convert it into something more liquid.” Ezra Levin of CFED noted the sheer magnitude of these accounts saying the “GAO estimates that just 314 accounts have about $81 billion stashed away. That comes out to an average of about $258 million each.” The GAO estimates that the federal government will forgo $17.45 billion in tax revenue in 2014 due to Mega-IRAs. In response to the report, Senate Finance Committee Chairman Ron Wyden sent a letter to Treasury Secretary and IRS Commissioner urging them to move forward on implementing GAO’s recommendations.

The Bipartisan Policy Center hosted an event on retirement savings this week, “Threats to Retirement Security: Longevity, Long-Term Care and Leakage.” The panelists had a deep and nuanced discussion about the challenges of long-term care, the need for effective social insurance, and the danger of isolating the issue of retirement savings from the real savings needs that unfold over the course of everyone’s life.

Child Care

The Child Care and Development Block Grant Act (CCDBG) of 2014 was signed into law Wednesday. The Hill’s Ramsey Cox reported on the 88-1 Senate vote to accept slight changes made by the House and send the bill on to the President. The Center for Law and Social Policy (CLASP) released a fact sheet on the legislation, stating the law makes “improvements to the health, safety and quality of child care, while also providing better and sustained access to child care assistance for low-income working parents.” Nedra Pickler of the Star Tribune summed up how the law altered the existing CCDBG, “The new law will require states to conduct at least one inspection annually of daycare centers receiving federal funds… The law also allows parents whose incomes rise above the program's limits to continue receiving child care for at least a year.”

Brigid Schulte wrote on a report by the Center for the Study of Child Care Employment that found “nearly half of all child-care workers are so poor that they qualify for public assistance like food stamps, Medicaid and the Earned Income Tax Credit.” New America’s Education program hosted an event to probe the findings of the report, “Worthy Work, Still Unlivable Wages.”

Education

The Washington Post covered some of the barriers low-income students experience figuring out how to pay for college. Danielle Paquette told the story of Surafel Adere, a student struggling to finance his college education. For Adere and many other low-income students, paying for school is an “exercise in accounting.” Paquette pinpointed some of the issues facing these students and observed that “confusion between a college’s sticker price — the advertised price for fees, board and tuition — and the net price — what students pay after receiving aid — can separate the country’s brightest students from better futures.” Jeff Guo wrote a piece that expanded upon these concerns: “Scared off by published prices for colleges, low-income students often don’t even apply to prestigious private schools, many of which give out the most aid.” Guo charted the relationships between a college’s wealth and its generosity toward the poorest of its students.

Quick Hits

New America’s Asset Building Program hosted “Trapped in America’s Safety Net,” an event that explored the ways in which means-tested benefits lock disabled and poor individuals and families in at their lowest point and how we can better address their needs. You can watch the event here.

Chris Morran of Consumerist covered the Consumer Financial Protection Bureau’s proposal to make prepaid cards safer and less costly with protections like free access to account information, error resolution rights, and fraud and lost-card protection.

Wall Street Journal’s Neil Shah reported on a new study by demographers Mark Mather and Beth Jarosz of the Population Reference Bureau that mapped the nation’s rates of inequality and poverty and found the highest rates of both in the South.