Inequality

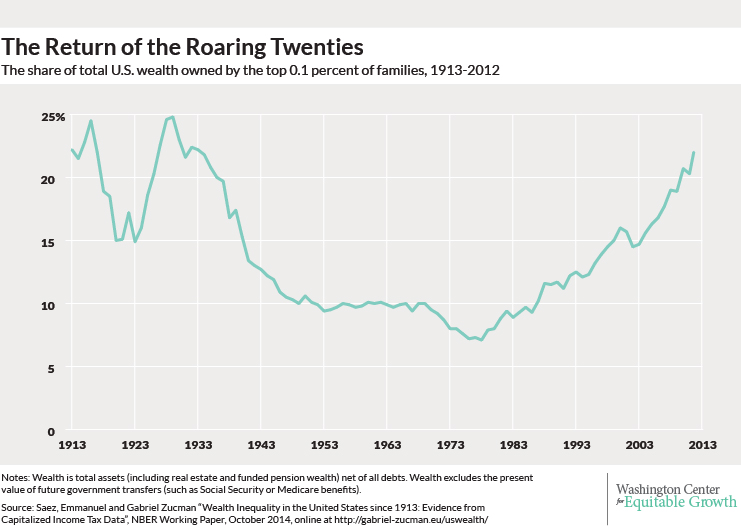

New studies show economic inequality has been on the rise for decades. Economists Emmanuel Saez and Gabriel Zucman published new research that examined the concentration of wealth over time, finding a u-shape trend since 1913: “The share of wealth held by the top 0.1 percent of families is now almost as high as in the late 1920s, when ‘The Great Gatsby defined an era that rested on the inherited fortunes of the robber barons of the Gilded Age.”

Similar findings were echoed by Ben Walsh of the Huffington Post, who shared the results of a study by economists Fabian Kindermann and Dirk Krueger that focused on income inequality. The research fingered a historically low top marginal tax rate as a major cause of inequality. According to Krueger, “High marginal tax rates provide social insurance against not making it into the 1 percent… [the optimal top marginal tax rate is] somewhere between 85 and 90 percent.”

Education

Low-income students enroll in and graduate from college at a lower rate than students with parents on higher rungs of the economic ladder. Even when controlling for ability, poor students have a slimmer shot at college success: according to Jeff Guo of the Washington Post, “Low-income students who scored between 1200 and 1600 on their SATs were half as likely to finish college as their counterparts in the top 25 percent of the income distribution.”

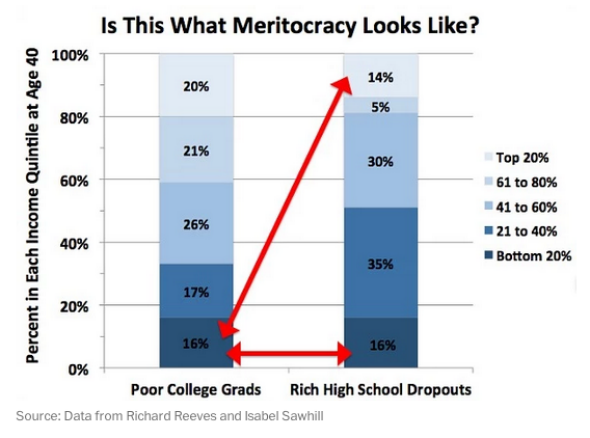

When low-income students do graduate from college, their degrees are no golden ticket to financial success. The Washington Post’s Matt O'Brien published a chart, based on a new paper from Richard Reeves and Isabel Sawhill, which shows low-income students who graduate from college have the same chances (16%) of ending up at the bottom of the income distribution by age 40 as high school dropouts from wealthy families. Jordan Weissmann of Slate discussed O’Brien’s article, emphasizing that low-income students who graduate from college are more likely to end up in the top 40% of earners than wealthy high school dropouts.

Child Poverty

According to a new report published the journal JAMA Pediatrics, child poverty is at its highest point in 20 years. Gale Holland covered the story in the LA Times, saying “As the U.S. emerges from the worst recession since the Great Depression, 25% of children don’t have enough food to eat and 7 million kids still don’t have health insurance.” The nearly 4 million children that receive housing assistance are frequently placed in high-poverty neighborhoods, which are often violent, stressful, and hazardous, and can have adverse effects on children’s development and health. In a new commentary for Spotlight on Poverty and Opportunity, Barbara Sard of the Center on Budget and Policy Priorities discussed these issues and ways to help children live in better neighborhoods.

Quick Hits

New America’s Asset Building Program hosted Millennials Rising: A Cross-Cutting Policy Symposium with partners Young Invisibles and the Roosevelt Institute. The materials from the symposium are available here.

The IRS announced changes to retirement plan contribution limits, the maximum annual 401(k) contribution is now $18,000, and the Saver’s Credit is now available to tax filers with slightly higher incomes, more to come on this topic.

Forbe’s Richard Eisenberg explored that retirement crisis among the LGBT community, noting that “51% of LGBT older people are very or extremely concerned about having enough money to live on in retirement.”

Devin Fergus scrutinized excessive fees and predatory charges and made recommendations for reform in his op-ed “Ending This Fee for All”, which ran in the New York Times.

Danny Vinik of the New Republic reported on a new study which found no evidence that minimum wage increases reduce employment rates.