Millennials

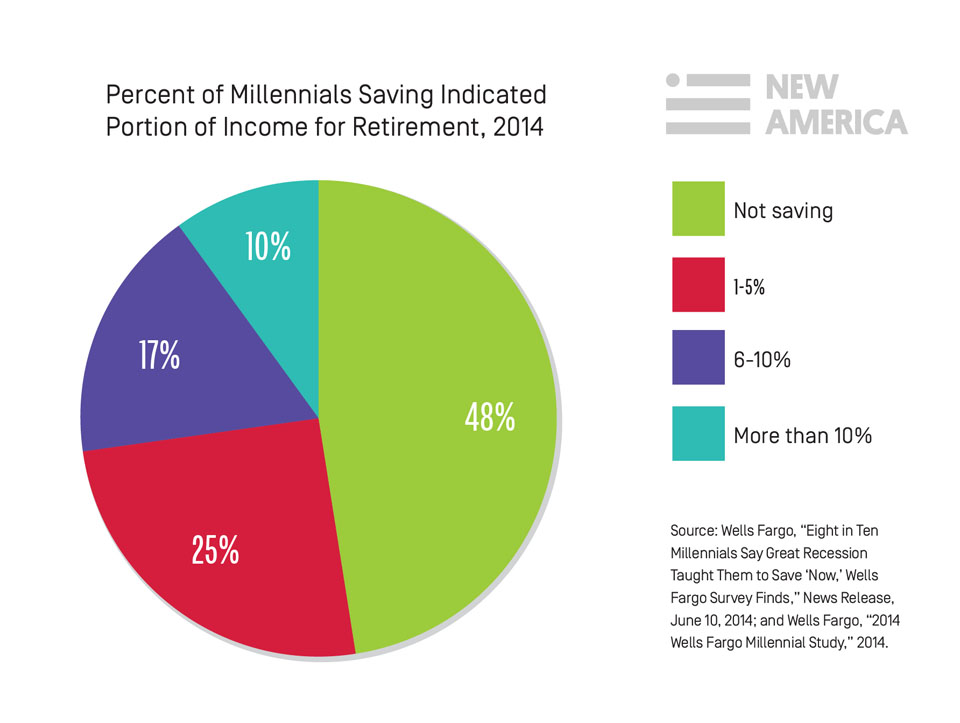

New America authored a six-part series on the status of Millennials in the wake of the Great Recession that was published by Vox.com this week. Titled “Millennials Rising,” the articles delved into a range of challenges facing young adults after the economic and political tumult of the early 21st Century. Reid Cramer of New America’s Asset Building Program provided an overview of the Millennial challenge: “The Great Recession derailed many young people, and spawned an atmosphere of economic precariousness that's undermining their potential, reordering their aspirations, and complicating their key life decisions.” He called for “a policy agenda capable of reversing downward mobility, increasing access to affordable education and training, supporting young families, making child rearing less costly, and cultivating economic resiliency.” The Asset Building Program’s Elliot Schreur took a closer look at homeownership among Millennials and its impact on wealth building over a lifetime. He charged “the combined impact of the national flood of foreclosures, the loss of trust in the housing market, and the tighter mortgage standards” with bringing the rate of homeownership among 25- to 29-year-olds to “record lows.” Schreur identified antiquated wealth building policies that emphasize homeownership and disproportionately reward the wealthy for saving as major barriers to savings among Millennials.

Economists from the Federal Reserve weighed in on one of the questions raised by “Millennials Rising”, why are so many Millennials moving in with their parents? As reported by Slate’s Jordan Weissmann, they found that student debt is a major factor.

Housing

Affordable housing in major American cities is becoming an increasingly rare commodity. Derek Thompson described this trend in The Atlantic, noting “Among the 100 largest U.S. metros, 63 percent of homes are "within reach" for a middle-class family... But among the 20 richest U.S. metros, just 47 percent of homes are affordable.” David Muller explored the impact of this crunch for Detroit residents who receive housing assistance – many of whom are being forced out of their homes as new owners of redeveloped properties no longer accept Section 8 housing vouchers. Alana Semuels featured a Baltimore group Housing Our Neighbors that is working to solve the city’s housing crisis by turning the more than 16,000 vacant homes in Baltimore into affordable housing units.

Discrimination

Ned Resnikoff reported on a new study by the labor group Restaurant Opportunities Center United (ROC United) that found widespread discrimination in the restaurant industry. According to Resnikoff, “Workers of color are said to receive 44% of the earnings taken in by similarly qualified white people, leading ROC United to suggest there’s a 56% “race tax” across the industry. Similarly, women were found to pay an 11% “gender tax.” Janie Boschma examined the impact of an even economic playing field for racial minorities in the National Journal. She covered a new report by The Equity Solution that investigated the potential impact of eliminating the pay gap between whites and people of color. The research submits “The U.S. economy—and that of every large metro area—would soar if minorities had equal access and opportunities in the job market.”

Quick Hits

Brookings’ Richard V. Reeves highlighted large, and possibly growing, gaps in educational attainment by socioeconomic background: “Almost half (46%) the children of top-quintile parents ended up in the top education quintile themselves, and three in four (76%) stayed in one of the top two quintiles.”

Christopher Ingraham reported that child poverty in the United States is among the worst in the developed world.

Henry J. Aaron of Brookings wrote on potential policy avenues for dealing with the declining solvency of the trust fund that supports benefits for the disabled.

The Urban Institute released a brief that discusses the opportunities and challenges of providing small-dollar credit products.