Work

Last Friday was the first Friday of the month, which means the Bureau of Labor Statistics released its jobs report for September. Gary Burtless reflected on the data in a blog post for Brookings. He pointed out that despite the good news about jobs gains in the past few months, wages have not followed the same upward trajectory. Specifically, “wages remain stuck despite of 48 successive months of job gains,” which he suggests is an indication that “employers’ bargaining power remains exceptionally strong.” Jared Bernstein agrees: “It’s purely an employer’s-got-the-upper-hand story.” Although the economy is growing, wages remain stagnant because of lingering slack from the recession and decades-long economic trends that have pushed us to the point that Bernstein can write this stunning line, “The U.S. business model has devolved to a point where raising pay is antithetical to sound practice.”

Inequality

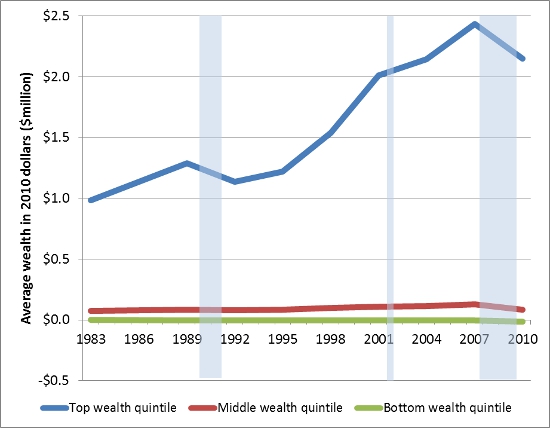

Signe-Mary McKernan and Caroline Ratcliffe of the Urban Institute wrote a blog post for the London School of Economics about their recent research on the connection between the federal government’s asset-building subsidies and inequality. Wealth inequality is worsening, they find, and the regressive federal subsidies in place to support asset creation are exacerbating the problem. Here is one powerful chart from their post:

Robert Peston pushed back against the notion that promoting equality comes at the cost of slower economic growth. In fact, he argues, “inequality is not the friend of faster growth.” This claim follows the announcement of “the new orthodoxy at that most establishment and conservative of financial institutions, the International Monetary Fund,” which now maintains the position that high levels of inequality are a drag on economic growth.

Youth Savings

To mark the recent publication of two reports on the YouthSave project, we hosted an event at New America on experiences from YouthSave titled, “A Multi-Generational Approach to Global Poverty Alleviation.” The event featured our own Scarlett Aldebot-Green along with other experts in the field who have worked on the YouthSave project. You can find our recent report on “regulatory environments for youth savings in the developing world,” which was featured at the event, here.

In the U.S., efforts to promote youth savings on a large scale include proposals for a system of universal children’s savings accounts. CFED’s Andrea Levere wrote an op-ed for The New York Times on the importance of this endeavor for college affordability.

Another policy proposal to help youth is to extend the EITC to young people, many of whom need more support in a tough labor market. Karen Weise for Bloomberg Businessweek described the organization Generation Progress’s plan to do just that.

Quick Hits

The Illinois Asset Building Group’s 2014 Conference was this week in Chicago. The event brings together asset-building practitioners from around the state and across the country to discuss best practices and to hear from experts about asset-building policies and interventions. Our own Justin King participated in a panel on children’s savings accounts.

The Center for American Progress released a new brief proposing ways to leverage the Earned Income Tax Credit as an asset building tool and to offer an early access provision for the EITC as an alternative to payday loans.

Dylan Matthews described the results of a natural experiment that took place recently involving Syrian refugees in Lebanon. The evidence points to the effectiveness of direct cash aid as an anti-poverty measure.