The story Americans tell ourselves about the American Dream—who gets ahead, and how, and what our own chances might be—obscures and even intentionally ignores one powerful determinant of life chances: our parents’ financial standing, and the ways they pass on their advantages.

While analyses of economic mobility and persistent inequality frequently recognize the significance of parental investments in early childhood, parental transfers to adult children are also significant. Critically, these transmissions work in nearly invisible ways, allowing young adults to fall back safely in times of economic difficulty or to vault themselves up the economic ladder by affording greater options regarding additional education, career paths, and housing. Particularly at the critical transition to adulthood, the presence—or absence—of these resources may help to determine future economic trajectory, making the difference between a successful ‘launch’ of adulthood or, conversely, lingering economic insecurity. I’ve written a new analysis of parental transfers to adult children, By My Parents’ Bootstraps, that was just released by AEDI.

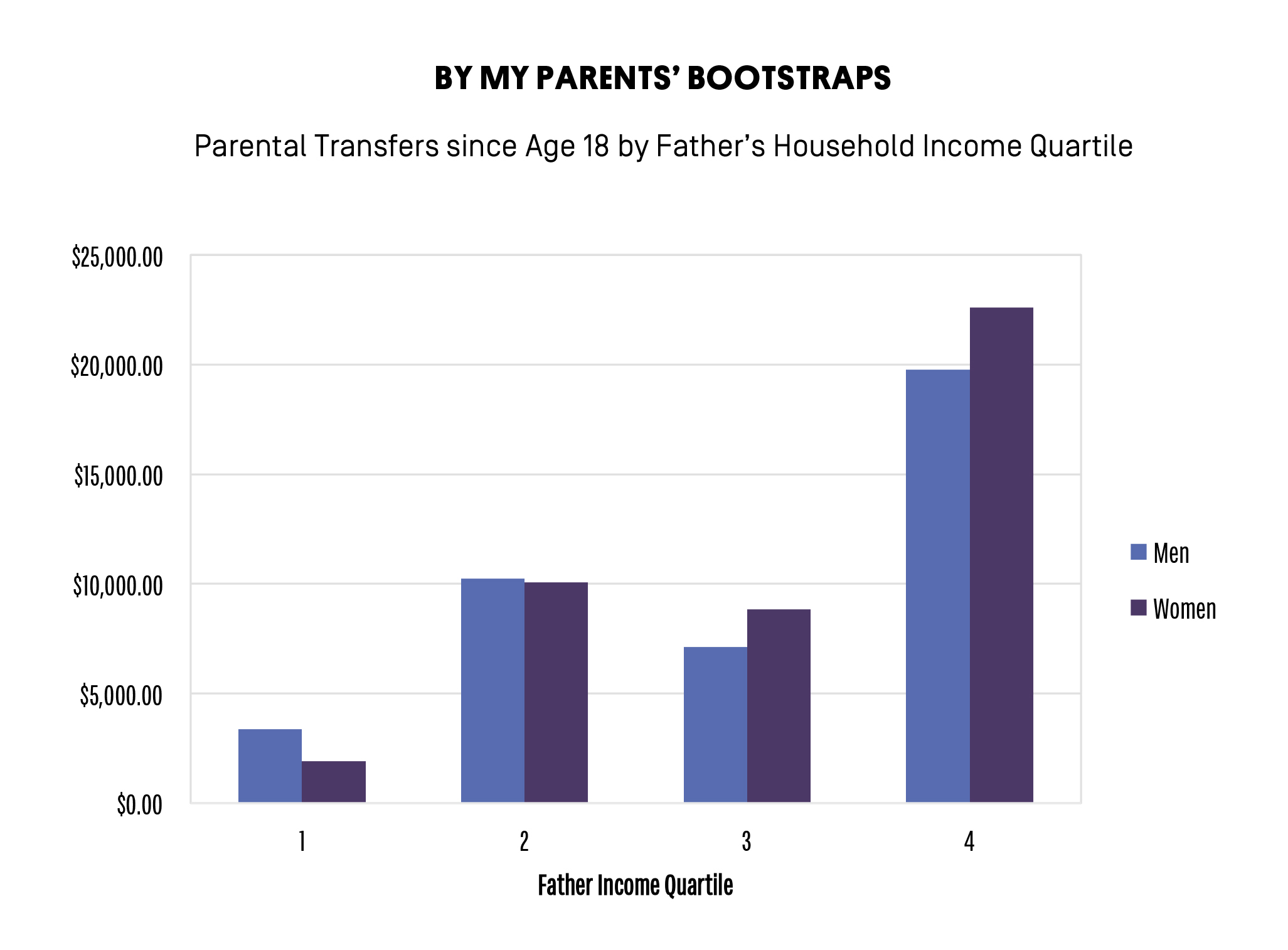

These parental transfers matter not just for determining the likelihood of one’s own economic mobility; their highly unequal distribution also make them significant in explaining inequality, as well. Indeed, the skew in the likelihood and size of transfer is so steep that ‘average’ transfer data obscure huge disparities. Adult children from high-income (4th quartile) households are three times more likely to receive parental transfers than those coming from less economically-advantaged backgrounds (1st quartile). Even among those adult children who receive transfers, there is significant disparity in amounts; individuals in the top quartile received more than six times the size of transfers than those in the first quartile; among women, the difference is even greater ($2,000 v. $23,000).

The purpose of these transfers varies, too, in ways important for influencing later economic mobility. Specifically, wealthier parents target a higher percentage of their asset transfers to higher education, which may increase the return on investment for their children, by helping them avoid high student debt, while encouraging the kind of human capital accumulation correlated to later prosperity. In multiple ways, then, parents use transfers to help their children’s economic fortunes more closely track their own, thus fostering greater intergenerational similarity in class and likely closing off some avenues of economic mobility. And these effects do not end with the one generation; adult children can use parental transfers to reproduce higher living standards—and superior opportunities—than they could otherwise afford, including to purchase a house in a better neighborhood, put their children in a better school, and/or save for their children’s educations.

While many Americans have little access to these parental transfers, public policy can learn from their effects and replicate the advantages that such well-timed investments afford. If parental transfers facilitate upward mobility and, particularly, the pursuit of higher education, young adults from disadvantaged backgrounds need financial assistance from non-parental sources to match the contributions to their peers. Here, the reality of parental transfers, even as it collides with our individualistic conception of success, suggests that such investments in the financial capability of young adults may be quite ‘American’ after all. Financial asset transfers at the period of ‘launch’ to adulthood—in the form of Children’s Savings Account (CSA) or similar account disbursement, assistance with first-time home purchase, or asset-based higher education transfer—could provide critical support to all young Americans and the kind of strong financial foundation that some can now take for granted.